Tax Preparation

Business Organizer.pdf

Adobe Acrobat document [562.3 KB]

Rental Property Organizer.pdf

Adobe Acrobat document [407.9 KB]

Tax regulations are in a constant state of change. At Redemption Accounting we stay up to date on the changes that effect you. We are authorized e-filers with ten years of tax preparation experience. We have an established history of efficiency and excellence. Redemption Accounting is open all year to help you prepare your current and back tax returns. We a here to serve you.

Our Tax Preparation Services:

- Personal tax returns (1040)

- S-Corporation tax returns (1120-S)

- Corporate tax returns (1120)

- Partnership tax returns (1065)

- Non-Profit tax returns (990 all variations)

- Estimates and Consultations

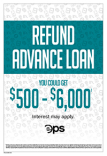

For your convenience, we offer e-collect.

With e-collect your tax preparation fees come directly out of your refund.

Also, if you do not have a bank account we offer the option for quicker access to your refund by printing you a check once the refund is funded. This is much faster than waiting on a check directly from the IRS.

Call today for your tax preparation appointment!

Expanded Tax Season Hours Begin 01/25/2024

| Monday, Tuesday, Thursday, Friday | 09:00 AM - 05:00 PM |

| Appointments available Monday through Friday during and after hours. | |

GET IN TOUCH

(770) 775-6464

Redemption Accounting

26 N. Mulberry St.

Jackson, GA 30233

Organizers

Rental Property Organizer.pdf

Adobe Acrobat document [407.9 KB]

Business Organizer.pdf

Adobe Acrobat document [562.3 KB]